| The truth is, choosing which van you want is the easy part. Unfortunately, figuring out how you will be able to budget for it isn't as easy. While your financial situation might not be the greatest, that van causing you all sorts of issues doesn't care about your budget. Therefore, you need to figure out how you are going to replace it. The reality is, you have two choices – either buy or lease. The Difference Between Buying and Leasing: Buying your car means you either got a loan or paid for it in its entirety. The benefits of buying a van are the ability to have ownership. The alternative that you can choose from is leasing the van. Keep in mind, some schemes will allow you to pay a lump sum at the end of the leasing period in order to purchase the vehicle to keep. Pros of Buying A Van: 1. Best Value You are generally going to be able to get the best price when you purchase it. After all, your negotiating leverage is significantly higher when you are negotiating with cash. Therefore, you can haggle to score a good deal. If you already have a van that you are willing to trade in, you can do so and experience even more savings on your purchase. You won't be restricted to only using your van for a specific set mileage that you agreed to at the beginning of the lease. This is one of the major pitfalls associated with leasing. 2. It's An Asset By actually purchasing your van outright, it becomes an asset and a part of your business. Therefore, you can do with it whatever you want whether it's selling it or trading it in. The Pros Of Leasing A Van:1. Fixed Monthly Cost One of the major advantages of leasing a van is the ability to have a cost that is fixed on a monthly basis. 2. Frequent Swaps Typically, this option is much better suited for those that are looking to drive a new van every couple of years. After all, once your lease is up, you have the option of walking away from it. Likewise, you can even lease out another van on a new agreement when the time comes. | 3. Forgo Maintenance Expenses This is typically a great option for businesses that don't want to have to continually spend money on maintenance costs as the van rapidly depreciates in value. A lot of the lease packages you will find on the market will include the maintenance costs that are incurred throughout the duration of the lease agreement which can make it much easier to avoid having your van turn into a money pit. Thus, if the van ends up breaking down, you can have the company fix it for you at no cost. A lot of lease companies will offer the choice of either getting a straight lease or agreeing to a lease-purchase. A lease purchase is the one that will give you the ability to purchase the van at the end of the lease term. Therefore, should you buy or lease? The main thing that you want to factor into your decision would be the cost. Van finance company Credit Capital says, “by choosing to purchase, you are going to end up taking a financial hit and you will be responsible for maintaining your vehicle.” They add, “you will also have to deal with the depreciation of your asset and all of the servicing costs. However, if you have the budget for it, buying can actually present you with savings over the long haul.” However, Financial Management Experts at Ceyor say “leasing will spread your payments over a set period of time and you will be able to forgo having to spend money on maintenance. It can also remove a lot of the risk associated with owning a business as they aren't counting towards your asset figure which means they can't be used to pay off debts if your business declares bankruptcy. With that being said, you have to deal with the pitfalls of having a mileage restriction which means you will have to pay significant penalties for going over the limit.” Likewise, you want to check to see what van insurance deals are available as some leasing companies will actually include needed insurance for the driver in the regular lease payments. You want to look closely at your balance sheet to ensure that you are able to afford it if you decide to purchase it. However, if you are uncertain you can, leasing is always an option. |

|

0 Comments

Leave a Reply. |

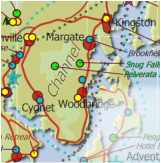

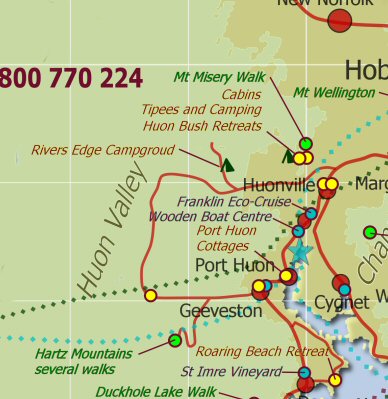

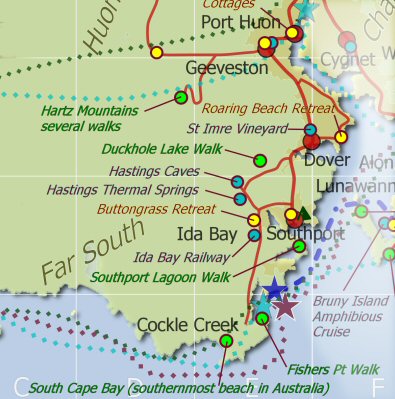

Huon Valley Escapes provides accommodation locations in the Huon Valley, Tasmania.

Call us from 9am to 7pm on 0427 648465 Blog Home:

|

|

Home

|

Choose

|

Getting to Tasmania

|

Help

|

About Us

|